Let’s talk about getting out of debt for a few. If you have read, listened or taken the class for financial freedom with Dave Ramsey’s program you should know what I’m talking about today. When my husband and I got married we had a lot of debt going into our marriage. We had the simplist wedding in Vegas with literally a few people. So that was a super smart move on our part to start with. So we didn’t start with wedding deb like the normal couple. I got pregnant 2 months into our marriage. Not a super shocker but it took us by surprise. Fast forward to 7 months pregnant. We wanted to buy a house so bad we went through 22 offers on homes in California just to get one. We moved in at 8 months pregnant and finally when I took leave I looked at our finances. I haven’t really been good with finances my whole life but it was time to grow up and look. We were trying to figure it all out before I stopped working for good. We had a huge decision to make but in the end it wasn’t a question, I had to quit working and stay at home to raise our boy. So I wrote down our finances with my husbands pay only. Well I almost had a heart attack but really I had a mega panic attack. We needed $1000 extra a month just to break even, without groceries. Uh, I freaked. When my husband drove home after a 3 hour commute I told him I had no idea what to do. He mentioned that he had heard about this guy Dave Ramsey and that I (we) should listen to his podcast. That night I downloaded it and started listening to it the next morning. From the first moment I started listening I was hooked. I started googling about getting debt free and came up with a plan. The first thing we started with was listing our debt from largest to smallest. Since I was going to get my paid leave for a few months I told him we HAVE to use every penny to pay off debt. Little by little and almost every week we paid off more and more little debts starting with the lowest debt. I cancelled, closed and shredded every credit card we had. Store credit cards are rip Offs by the way! You think you are saving by their rewards? Nope. Guess what? You have to spend to save…..think about it for a moment. So everything was gone! The next step….get rid of the horrendous new Honda Pilot I fleased, yes it’s a lease and the worst kind of car payment you can have. You are renting a vehicle and really burning a hole in your pocket. That’s why it is called a flease in Dave Ramsey’s terms. My husband looked shocked! He thought I was a little crazy to want to return this brand new vehicle I loved. It wasn’t important to me, what was important was changing our family tree. Taking stress off my husbands shoulders. He was the main and only money maker in the house now and I had to cut things out. Getting my hair done, not anymore. I go maybe once a year now instead of every 4-6 weeks. Going out to dinner, nope. Mindlessly spending, nope. That year we paid off thousands of dollars and so much that we actually had $1000 extra cushion in our budget! Love, love, love!

Let’s fast forward a bit. We got an offer to move to Virginia that I didn’t want to pass up. People were thinking we were crazy to move from “beautiful, sunny San Diego” to Virginia…..but we didn’t. We wanted out of our mortgage anyway. The area was closing in on us with pot growers also and I really wanted a safer environment for all of us. We put our the little house on over an acre on the market and sold it within 1 week! We were shocked and just ready! We packed up, moved to Virginia. We put our debt free on hold so we were comfy to move and wanted to start back when we got here. Well……we went backwards. We “needed stuff” when we got here. New bed (needed a king not queen size) , couch (all we had was a small leather couch), tv (ours broke within a month of moving), went out to eat and those sort of things. One thing we did well was biking everywhere which saved us mega! We only filled up once a month on gas and that was amazing. Instead of every week in California. So, 3 months after we moved I got pregnant again. So guess what? We kept the debt free on hold longer until he was born. It’s what you are supposed to do anyway in case something happens. Right when we were going to start back on our debt free journey we decided to move to a bidder house and better area. Prolonging our journey but honestly it was the best move ever for us. Oh and we also bought a Jeep. Ha! We don’t have share a vehicle anymore, which actually helps a lot. It’s older also, not brand new and it was not expensive, thank goodness.

So here we are two years after we move to Virginia. One kid was born(paid in cash), moved(paid in cash) , lots vet bills( paid in cash), dr bills (paid in cash) and acquired more debt(not paid in cash 😦 ).

Last week I got what Dave says, “I got mad at debt, like really pissed off”. Last week I told my hubby, “that’s it! Beans and rice, rice and beans. I’m done!”. He completely agreed and so here we are….. Mad at debt! Not prolonging it anymore and getting after debt once again.

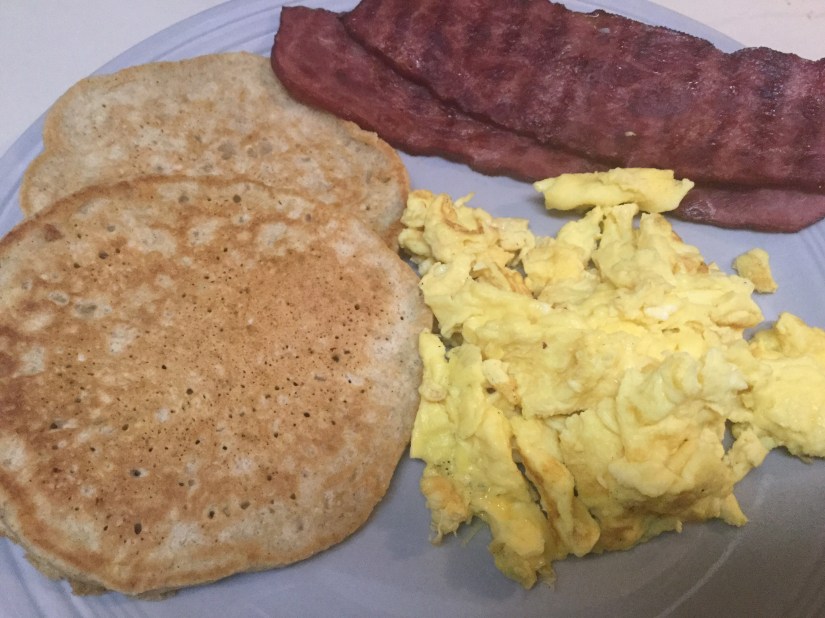

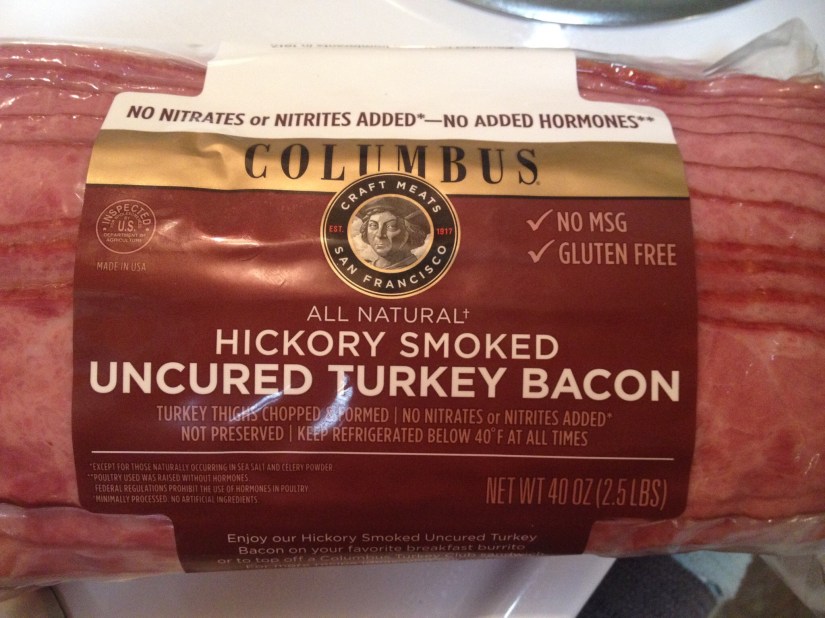

A question people ask or what I’ve heard people complain about is that they don’t want to eat beans and rice. I had some say they don’t want to eat crap. Um, did you know that brown rice, black beans, ground turkey, bell peppers, zucccini and broccoli is not crap. It’s yummy and health. We eat more than just that though, just smarter eating. And Um, he doesn’t mean you have to literally eat beans and rice. What he means is cut your grocery bill down. I eat super healthy and defenitetly healthier when we are getting out of debt. I lose weight and feel amazing. It truly is such an amazing lifestyle to eat healthy. And no, health food isn’t more expensive, it’s something you shouldn’t over think about. Stop drinking you fattening, super sugary Starbucks drinks. I bet you’ll cut your waistline down by just stopping that. And your wallet will thank you.

Here is our action plan:

1. My goal is to cut our grocery bills in half and use cash. Using cash scares me because I typically pick up items I believe we need but really we don’t. I don’t want to look stupid at the register and go over our allotted cash amount. Well, sometime you need to do things that are scary to succeed in life. So that’s what I am going to do. Also, I love Costco. Like absolutely love costco, but I seriously spend like $200 a week easily there. Then go to a grocery store and buy more. That is not necessary. So, I’m going to try to do away with Costco for the time being. Also, until winter hits and it’s is to cold, I will ride my bike to the grocery store to save money also. You can’t buy a bunch riding s bike, HA!

2. No more eating out. We don’t do this a lot anyway, but it’s gone completely for now.

3. I unsubcribed to all the clothing stores I get emails on and any other emails from regular stores as well. It will keep my mind in check on things we “need” but really don’t need.

4. I’m getting back to doing my surveys to get extra money. Recently I did surveys and bought my husbands PS4. He absolutely loves it! I typically buy our extra things with survey money. So I’m getting back to that.

5. Listen to Dave Ramsey podcasts. This is one way to getting my brain retired back to saving, it really has helped us a lot.

6. Encourage others to get debt free and feel less stressed. I see and hear a lot of stressed out people working for money just to buy things. It’s not a fun way to live. So if I can even help one person get on track to getting out of debt, I’ve done something life saving.

7. Get back to working out and look into personal training option. I have a passion for working out and really think it may be time for me to put it into action.

7. Practice making cakes and cupcakes, especially in the design area. I also have a passion for cakes, cupcakes and decorating. I really think it’s time to put my skills to work. Who knows, maybe it’ll help me reach out to others more and make a few bucks. As long as I can bring a smile to others that is a job well done.

If you have any questions one getting out of debt, just ask. I’m here for anyone who may need some help learning about it all. Join me on this journey, you (we) can do it!!

Live happy

Live debt free

Live simple